Economy… troubles and insights

At first, let’s consider this video about wealth inequality in America:

You may think that, after all, it is (rather) well known that people usually imagine normal (or Gaussian) distributions because such distributions are “sort of” natural. No surprise that they imagine both the ideal wealth distribution and the distribution they think is actual as something like a Gaussian curve.

We also know that the distribution laws used to describe the allocation of wealth among individuals, among which the famous Pareto distribution, are Power Laws, not Normal Laws. Normal laws are models of ordered hazard while power laws describe a “wild hazard”… and it seems that wealth distribution never belonged to the category people estimate.

Ok, let’s assume that wealth distribution belongs to the “wild hazard” category. Maybe this can be explained by the fact that our economies need investments and that innovation will only create jobs if somebody can put his own cash at risk. Accordingly, super-richs would be needed so that others can get a job.

Our hypothesis here would be that a wild distribution of wealth could be correlated to some economical sanity.

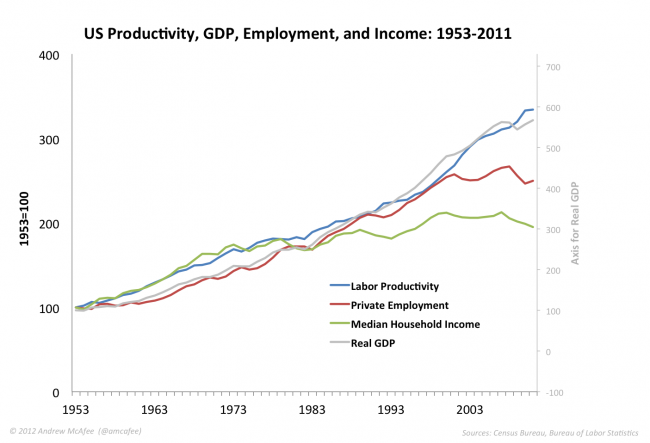

In a blog post by the title "The Great Decoupling of the US Economy", Andrew McAfee states that "the things that workers care about – jobs and wages – become decoupled from the the other things that economy-watchers care about". As demonstrated by a graph showing that GDP and Labour Productivity recently became uncorrelated from Employment and Median Household Income.

This chart is a sign that something new is at stake, and that the "economic sanity hypothesis" may have been valid but is probably no longer so. In this video, Clayton Christensen provides an insightful explanation of what probably caused the decoupling: the virtuous innovation cycle that drove the development of our industrial society has been interrupted because financial institution discovered that they can maximize profits using a short loop.

As Clayton Christensen describes it, it looks like a curse. But it also may be the sign that the industrial age paradigm, in which money fueled innovation, must be replaced by something new.

Of course, we can think of Jeremy Rifkin’s Third Industrial Revolution, but Rifkin’s starting hypothesis is that industrial revolutions always ignite with the shift to a new energy regime. Hence, the first of his "Five Pillars" reads shifting to renewable energy.

In my opinion, the Third Industrial Revolution must first be an information revolution before any energy regime revolution can occur. I strongly agree with Simon Phipps, who recently lead track called "Meshed Society and Freedom to Innovate" during last Open World Forum in Paris that the freedom to innovate in the modern, meshed society is being threatened by the legacy tools that regulated the control-point society inherited from industrial ages.

Freedom to innovate should now be the major priority. Allowing our meshed society to break current innovation short loop (by example to shift to a grid of renewable energy à la Rifkin) fully relies on breaking well established control points.

I was upset that the conclusion of Open World Forum’s track was mainly about asking governments or regions to pass new laws. In my opinion, the current political organization is inherited form the "horses ages" (when people had to elect a literate among them to represent others in a capital that was many days away by horse). In current electron age, where a meshed society can be born from the wisdom of crowds, the tenants of traditional (highly indirect) democracies hardly belong to the solution frame and are probably deeply rooted in the problem frame. Regions, governments or national assemblies may be the proper vector to help disseminate Libre Office but certainly not to allow a meshed society organize their obsolescence!

In her paper titled "Leverage Points Places to Intervene in a System", Donella Meadows orders places to intervene in a system. She states that the rules of the system is in 4th place, while the distribution of power over the rules of the system is in 3rd place, behind the goals of the system (2nd) and, first and most efficient "leverage point", the mindset or paradigm out of which the system arises.

As a conclusion, and using Donella Meadows’ leverage points in the proper order, I would say that it is now time to grow among our fellow world citizen the awareness that we can, and even should, adopt a new mindset. Cycling from the start of this post, I would also consider the second leverage point and question whether the goals of any system should be limited to make riches richer!